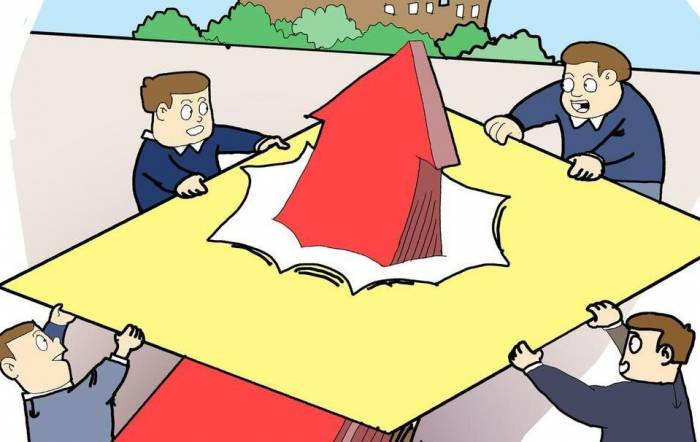

The A-share market has been fluctuating within a narrow range above the 3000-point level, and investors' sentiments have undergone significant changes, with some feeling anxious, some optimistic, and some disappointed. In this morning's article, I summarized several bullish views that have started to gain popularity in the market. Starting from the actual trend of the A-share market, I will provide a simple analysis and discuss with everyone how to respond and be well-informed.

First viewpoint: It's normal to adjust for a few days after rising by several hundred points.

1. This statement sounds unobjectionable because the A-share market has indeed risen by more than 400 points, and there has been no decent adjustment in between. It is normal for an adjustment to occur.

The stock market is unpredictable and changes rapidly. Before the market has adjusted, we cannot say that the adjustment is normal, given that it has risen by more than 400 points. If the adjustment leads to a rapid decline, breaking through all support levels, and with trillions of transactions every day above 3000 points, who will fund the market to cross this area after the adjustment? Who will take the lead? Relying on retail investors' bullish sentiment? This is obviously impossible.

Advertisement

2. The market has risen by several hundred points, but many individual stocks have doubled, with significant increases. For example, banks, oil, and coal have all set historical highs, but they have all been pulled up with reduced volume. This is a phenomenon that every retail investor should think about carefully.

This is not a big bull market, and the lack of volume pull-up, insisting on the divergence of volume and price, is just waiting for the appearance of the receiving funds. Do not ignore the role of technical analysis on A-shares. If technical analysis were useless, it would not have existed for nearly 200 years, and the main funds would not use the golden cross and death cross of moving averages to lure more and more.

3. It is normal for the market to fall after rising a lot, but the key is how it rises and how it should fall. Everyone should know that it is a sharp bottom pattern, which is not sustainable and does not have the conditions for a reversal. But now it is forming a round top. Why?

The purpose is to fully utilize this pull-up to maximize the delivery at a high position. Even if there is no sale, some of the trapped funds in some stocks have also contributed considerable profits to the market makers, enough to get through this year.Therefore, the dealer puts forward this statement to stabilize the emotions of the newly trapped funds in this wave of the market, so as not to escape prematurely, affecting the dealer's delivery, and also to comfort the funds that have been trapped for a long time. Don't worry, after the adjustment, you will be free. Since the dealer has trapped you, at this point, you are equivalent to being abandoned.

The second point of view: The big main force is to stabilize the market around 3000 points, and it will not fall again.

The big main force has not said to maintain the market near 3000 points to fluctuate, and there is no relevant report, saying that someone requires the main force in the field to do so, it is the dealer and some blindly optimistic bullish people's own imagination.

This point needs to be discussed from the background of this rebound. My article yesterday listed several bearish factors for everyone, among which the ghost child's interest rate increase is an event that we cannot control, but the impact on A-shares is obvious.

Therefore, this wave of the market is launched in a hurry, for fear of the index rebound, even at the expense of the divergence between volume and price, it also wants to pull up, from which we can see how urgent the main force's mood is, almost all the plates and varieties have been greatly speculated, and some individual stocks have exceeded the overall increase during the bull market in the short term.

If the market has a rapid rebound at this time, 3000 points, it is just a point, and it will be pierced at any time, so after a significant increase, it is still expected to rise significantly again, which is unrealistic.The third viewpoint: The pullback is precisely a good opportunity to buy low.

This round of rebound is as confusing as a blind man feeling an elephant. Why is it rising? The big background, I have also given you examples above, and I have also analyzed the target of this rebound for everyone. There is a question here, how do you know that the pullback is just a car picking up people, and it is a good opportunity to absorb?

There are ten thousand possibilities in the stock market, but there are only two trends, either rising or falling. It has risen 400 points without turning its head. If it does not break through upward quickly after this horizontal consolidation, the pullback is not a pullback, but the end of the market. How can it be a good opportunity to absorb?

This viewpoint is the prelude that the market maker has made in advance for its own second delivery at a high position. It is just to let the funds that come out at a high point and the funds that have not entered the market, enter the market again at an important technical support position, and then find a way to trap them and make a big profit.

Because it is a sharp bottom pattern, this rapid rise indicates that something urgent has happened. Not many funds entered during the rapid rise. After it rose to 2950 points, people began to enter the market with confidence and boldness.

The market continues to set new highs, but the average stock price of A-shares no longer sets new highs, indicating that a large number of funds have been trapped. The next step is to deliver at a high position, which requires people to have the awareness that the pullback is to absorb, and to mobilize early, so that it will not be difficult to cut another batch at that time.

Fourth, those who shout down are all missing the market.

This is actually a false proposition. There are 5,300 stocks in A-shares. If you miss the market, that would be a miracle. During the early stage of the market's rapid rise, buying any stock at random also has a rise of more than 20%. Therefore, there is no such thing as missing the market in the A-share market.All those who proclaim a market decline are actually missing out; their inner selves are weak and fragile because they are too afraid of a market downturn and cannot bear to hear the word "decline," which could turn their meager profits into nothingness.

It is anticipated that after this rebound, the A-share market will quickly resume the issuance of new shares. After all, despite all the reforms, the A-share market remains primarily a market for financing, and financing for enterprises is the fundamental purpose.

Therefore, missing out in the A-share market is not an option. People who say such things are either deceiving retail investors to bring money into the market to take over positions or they themselves are too afraid of a decline, lacking confidence, and bluffing. When we hear such rhetoric, we retail investors, standing in the context of the A-share market with 5,300 stocks, will know whether we are missing out, because the market has enough stocks for you to calmly and confidently choose from.

The above is the so-called bullish viewpoint that is currently popular in the market. At the end of an uptrend, various viewpoints emerge, which is a good thing. Full communication and discussion can help us see the market's trend more clearly, facilitating our operations as retail investors and reducing mistakes.

I hope everyone in the stock market, while paying attention to risks, can freely be bullish or bearish, find the right timing for operations, and achieve not being greedy or attached, protecting their principal, because the A-share market will not close.

Comments